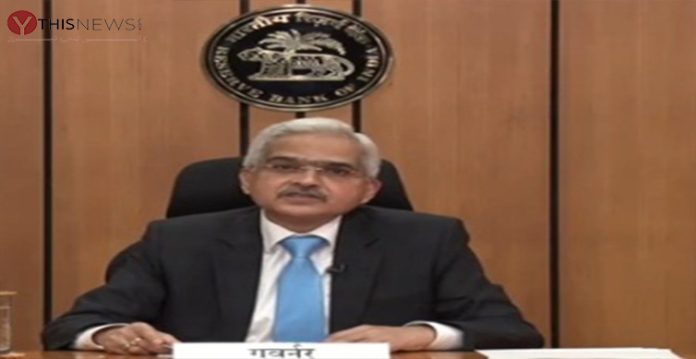

As per the latest updates, the Reserve Bank of India has raised the repo rate by 50 base points to 4.9 percent, Governor Shaktikanta Das said on Wednesday, adding that inflation would probably stay over the upper tolerance level for 3/4 of this financial year.

He was talking at a public interview after the finish of the three-day financial strategy survey meeting that began on Monday.

However, the RBI bringing strategy rates up in the continuous money related approach board of trustees meeting was a “no brainer”, as said by its Governor Shaktikanta Das in a new meeting, financial backers, be that as it may, anticipated the genuine level of rate climb prior to taking new positions and future game-plan in the financial business sectors.

Toward the beginning of May, the RBI, in an unexpected off-cycle meeting, climbed the repo rate by 40 base points (bps) to 4.40 percent, in the midst of rising inflation worries in the economy. Repo rate is the rate at which the national bank loans momentary assets to banks.

ALSO READ: 75% of rise in inflation projection for FY23 due to food: RBI

In a similar off-cycle meeting, the case save proportion was climbed by 50 base points to 4.5 percent basically to press out some liquidity from the framework.

India’s retail inflation advanced to 7.79 percent in April, staying over the resilience furthest reaches of the national bank RBI for the fourth month straight. Almost certainly, the retail inflation will stay over 6% for an additional couple of months.

Das on Wednesday completely said India’s retail inflation is probably going to remain over the tolerance level till the second from last quarter of FY23 prior to directing under 6%.

For FY23, RBI sees generally inflation at 6.7 percent, with 7.5 percent in Q1, 7.4 percent in Q2, 6.2 percent in Q3, and 5.8 percent in Q4, thinking about the typical storm and normal unrefined petroleum crate cost of $105 per barrel.

Strikingly, discount inflation in the nation has been in twofold digit for north of a year at this point.

Coming to development, India’s genuine GDP development in FY23 is seen at 7.2 percent, will be 16.2 percent in Q1, 6.2 percent in Q2, 4.1 in Q3, and 4.0 in Q4, with gambles extensively adjusted, Das said.

(This story has been sourced from a third-party syndicated feed, agencies. Raavi Media accepts no responsibility or liability for the dependability, trustworthiness, reliability, and data of the text. Raavi Media management/ythisnews.com reserves the sole right to alter, delete or remove (without notice) the content at its absolute discretion for any reason whatsoever.)