As per the latest reports, domestic equity benchmark files watched out for their initial meeting misfortunes all through the meeting and settled lower on Tuesday, as the general feelings actually stay careful among investors as they are stressed over expansion and benchmark loan costs.

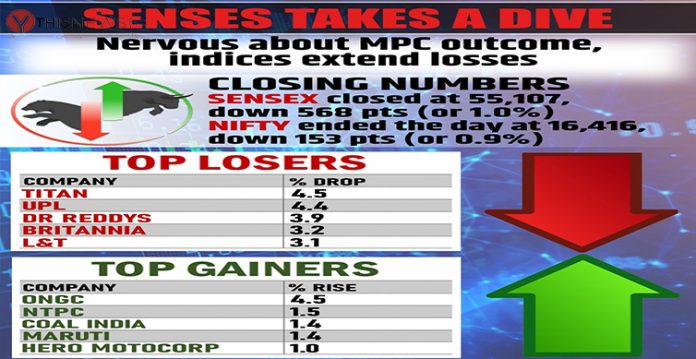

Sensex shut the day at 55,107 places, down 1%, while Nifty at 16,416 places, was down 0.9 percent. The RBI’s position on the economy and the genuine measure of ascend in key loaning rates would direct further strategy in the capital business sectors.

ALSO READ: Equities rise further post RBI’s MPC policy statement; Sensex up over 350 pts (Ld)

The national bank’s Monetary Policy Committee (MPC) audit meeting, which is in progress, will uncover its choice on Wednesday morning. However the Reserve Bank of India bringing strategy rates up in the continuous money related arrangement board of trustees meeting is a “easy decision”, as said by its Governor Shaktikanta Das in a new meeting, investors, in any case, anticipate the genuine level of rate climb prior to taking new positions and future game-plan in the monetary business sectors.

“The unpredictability in the market is constraining investors to remain sidelined in front of the RBI’s strategy declaration. The market has figured a climb up to 50 premise points of repo rate and CRR, yet any further stricter measures to cinch liquidity because of waiting expansion will have implications available pattern,” said Vinod Nair, Head of Research at Geojit Financial Services.

Given the international strains seen on the worldwide front, the Center has expanded its protection use expense, which forecasts well for the safeguard related stocks, said Ashwin Patil, Senior Research Analyst at LKP Securities, adding that he is positive on guard maker Bharat Electronics.

(This story has been sourced from a third-party syndicated feed, agencies. Raavi Media accepts no responsibility or liability for the dependability, trustworthiness, reliability, and data of the text. Raavi Media management/ythisnews.com reserves the sole right to alter, delete or remove (without notice) the content at its absolute discretion for any reason whatsoever.)